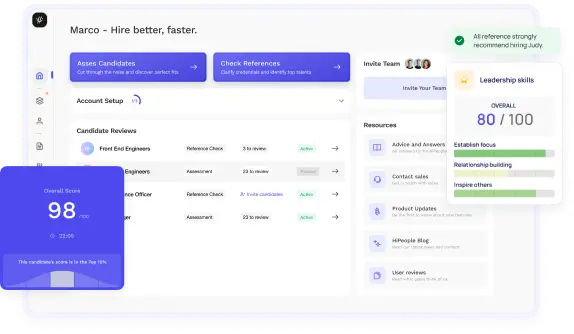

Streamline hiring with effortless screening tools

Optimise your hiring process with HiPeople's AI assessments and reference checks.

Are you ready to ace your bank teller interview and secure your spot in the banking industry? Mastering the art of answering bank teller interview questions is crucial for both employers seeking top talent and candidates aiming to land their dream job. In this guide, we'll explore everything you need to know about the bank teller role and dive deep into the most effective interview questions designed to assess candidates' skills, competencies, and cultural fit. Whether you're a seasoned interviewer or a job seeker preparing for your first banking interview, this guide will equip you with the knowledge and strategies to succeed in the competitive world of bank teller interviews.

Before delving into the intricacies of the interview process, it's essential to grasp the fundamental aspects of the bank teller role. Bank tellers serve as the frontline representatives of financial institutions, playing a pivotal role in delivering quality customer service and facilitating various banking transactions. Their responsibilities encompass a wide range of tasks, including processing deposits and withdrawals, assisting customers with account inquiries, promoting bank products and services, and ensuring the accuracy and security of financial transactions. Bank tellers are expected to possess excellent communication skills, attention to detail, and proficiency in handling cash and banking software.

Conducting a successful bank teller interview requires asking the right questions to assess candidates thoroughly. Effective interview questions serve several crucial purposes:

Effective bank teller interview questions go beyond generic inquiries and delve into the specific competencies, behaviors, and attributes required for success in the role. By tailoring questions to the job requirements and organizational values, employers can make informed hiring decisions and select candidates who are best suited to excel as bank tellers.

If you're considering a career as a bank teller, it's crucial to understand the core responsibilities and qualifications associated with the role. Let's delve into what it means to be a bank teller and what skills you'll need to succeed in this position.

As a bank teller, you'll serve as the face of the bank, interacting directly with customers on a daily basis. Your primary responsibilities will include:

To excel as a bank teller, you'll need a combination of interpersonal skills, technical abilities, and attention to detail. Some essential qualifications for the role include:

In addition to these qualifications, many banks may require a high school diploma or equivalent, although some positions may prefer candidates with post-secondary education in finance or related fields. Prior experience in customer service or cash handling roles can also be beneficial when applying for bank teller positions.

How to Answer: Explain your approach to managing difficult customers with empathy, patience, and problem-solving skills. Highlight your ability to stay calm, listen actively, and find a resolution that satisfies the customer while adhering to the bank's policies.

Sample Answer: "When dealing with a difficult customer, I first listen carefully to understand their concerns without interrupting. I empathize with their situation by acknowledging their feelings and reassuring them that I am here to help. For instance, if a customer is upset about a fee, I would explain the reason for the fee, check if there's any way to waive it based on the bank's policy, and offer alternative solutions to prevent it from happening again. My goal is to ensure the customer feels heard and leaves with a positive impression of our service."

What to Look For: Look for candidates who demonstrate empathy, patience, and problem-solving skills. They should show an ability to stay calm under pressure and a commitment to customer satisfaction. Red flags include a lack of empathy or a confrontational attitude.

How to Answer: Share a specific example that illustrates your dedication to exceptional customer service. Focus on the actions you took and the positive outcome for the customer.

Sample Answer: "At my previous job, a customer came in worried about a fraudulent charge on their account. Although it was close to closing time, I took the time to investigate the issue thoroughly. I contacted the fraud department, assured the customer we were handling it, and followed up with them the next day to ensure the charge was reversed. The customer was extremely grateful and became a loyal client because of the extra effort I put in."

What to Look For: Candidates should provide a clear, specific example that highlights their proactive approach and commitment to customer service. Look for a genuine desire to help customers and a willingness to go the extra mile. Vague or general answers can indicate a lack of real-life experience.

How to Answer: Detail your previous experience with cash handling, including the types of transactions you performed, the volume of cash you managed, and any relevant procedures you followed.

Sample Answer: "In my previous role as a cashier, I handled various transactions including deposits, withdrawals, and check cashing. I managed large sums of money daily, ensured accurate cash counts, and balanced the drawer at the end of each shift. I am familiar with bank-specific software and understand the importance of maintaining accuracy and security in all transactions."

What to Look For: Look for candidates with concrete experience in cash handling and transaction processing. They should demonstrate accuracy, attention to detail, and familiarity with relevant banking procedures. Red flags include vague descriptions of experience and a lack of specifics.

How to Answer: Explain the steps you take to verify transaction accuracy and maintain security, emphasizing your attention to detail and adherence to protocols.

Sample Answer: "To ensure accuracy, I double-check all transaction details, including account numbers and amounts, before finalizing. I follow strict protocols for cash handling, such as counting cash multiple times and securing it promptly. For security, I verify customer identification for large transactions and stay vigilant for any suspicious activities. These practices help prevent errors and ensure the safety of our customers' funds."

What to Look For: Candidates should show strong attention to detail and a methodical approach to ensuring transaction accuracy and security. Look for specific examples of their diligence and understanding of security protocols. Red flags include a lack of concrete procedures or an overly casual attitude towards security.

How to Answer: Provide a specific example of a problem you identified and resolved proactively. Highlight your critical thinking skills and your ability to take initiative.

Sample Answer: "In my previous job, I noticed a recurring error in the way a certain type of transaction was being processed, which was leading to customer complaints. I investigated the issue, identified the root cause as a software glitch, and reported it to the IT department. I also suggested a temporary workaround to my team to prevent further issues. As a result, we were able to address the problem quickly and minimize customer impact."

What to Look For: Candidates should demonstrate proactive problem-solving skills and the ability to take initiative. Look for specific examples that show their critical thinking and how their actions led to a positive outcome. Red flags include a lack of specific examples or a reactive rather than proactive approach.

How to Answer: Explain your approach to time management and prioritization, including any tools or strategies you use to stay organized and focused.

Sample Answer: "I prioritize tasks by assessing their urgency and importance. I use a task management tool to keep track of deadlines and set reminders. For example, if I have multiple customers waiting and an urgent report to complete, I might quickly assist the customers first and then focus on the report. I also communicate with my team to delegate tasks if needed, ensuring everything gets done efficiently."

What to Look For: Candidates should demonstrate strong organizational skills and the ability to manage their time effectively. Look for specific strategies they use to prioritize and stay organized. Red flags include a lack of clear prioritization methods or difficulty managing multiple tasks.

How to Answer: Describe your experience working in a team, including how you contribute to team efforts, communicate with colleagues, and resolve conflicts.

Sample Answer: "I believe effective teamwork is about communication and collaboration. In my previous job, our team had a monthly sales target to meet. I regularly communicated with my colleagues about our progress and shared tips on best practices. When conflicts arose, I addressed them openly and constructively to ensure we stayed focused on our goal. Our team consistently met or exceeded our targets because we supported each other and worked together."

What to Look For: Candidates should demonstrate a cooperative attitude and strong communication skills. Look for examples of successful teamwork and the ability to resolve conflicts constructively. Red flags include a lack of teamwork examples or difficulty working with others.

How to Answer: Highlight your communication skills, including how you convey information clearly and listen actively. Provide examples of effective communication in different contexts.

Sample Answer: "I ensure clear communication by being concise and straightforward in my interactions. When speaking with customers, I confirm their understanding by asking clarifying questions and summarizing key points. With colleagues, I use clear, written communication for important information and follow up in person when needed. For example, I once coordinated a promotional event by sending detailed emails and holding regular meetings to ensure everyone was on the same page."

What to Look For: Candidates should demonstrate clear and effective communication skills, both verbal and written. Look for examples of their ability to convey information and ensure understanding. Red flags include unclear or vague communication methods.

How to Answer: Explain your methods for keeping up-to-date with industry changes, such as attending training sessions, reading industry publications, or participating in professional networks.

Sample Answer: "I stay updated with banking regulations and new financial products by regularly attending training sessions offered by the bank. I also subscribe to industry publications and join online forums and professional networks to discuss changes with peers. For example, I recently completed a certification course on the latest compliance regulations, which helped me better serve our customers and ensure our practices are up-to-date."

What to Look For: Candidates should show a proactive approach to continuous learning and staying informed about industry changes. Look for specific methods they use to keep their knowledge current. Red flags include a lack of ongoing education or awareness of industry developments.

How to Answer: Provide a specific example of a time you had to learn something new quickly or adapt to a change. Focus on your ability to learn and adapt efficiently.

Sample Answer: "At my previous job, our bank introduced a new software system for transaction processing. I had to quickly learn how to use it to ensure seamless customer service. I took the initiative to attend additional training sessions, practiced during off-hours, and asked colleagues for tips. Within a week, I was proficient with the new system and even helped train others, ensuring our team adapted smoothly to the change."

What to Look For: Candidates should demonstrate adaptability and a willingness to learn new skills quickly. Look for specific examples that show their ability to handle change and support others in the process. Red flags include resistance to change or difficulty learning new skills.

How to Answer: Discuss techniques for building relationships with customers, such as active listening, personalizing interactions, and maintaining a friendly and professional demeanor.

Sample Answer: "I build rapport by actively listening to customers and showing genuine interest in their needs. I use their names, remember their preferences, and ask follow-up questions about previous interactions. For instance, if a customer mentioned they were going on vacation, I would ask how their trip was the next time I saw them. This personal touch makes customers feel valued and helps build long-term relationships."

What to Look For: Look for candidates who show an understanding of relationship-building techniques and provide specific examples of their methods. Red flags include a lack of personal interaction or a purely transactional approach to customer service.

How to Answer: Share a specific example that demonstrates your conflict resolution skills and ability to improve a customer's experience.

Sample Answer: "A customer once came in upset about a delayed wire transfer. I listened to their concerns, apologized for the inconvenience, and immediately investigated the issue. I kept the customer informed throughout the process and ensured the transfer was completed as soon as possible. I also offered a small compensation for the inconvenience. The customer appreciated the effort and left satisfied, later thanking me for resolving the issue promptly."

What to Look For: Candidates should provide a clear example of turning a negative situation into a positive one. Look for problem-solving skills, empathy, and a proactive approach. Red flags include vague responses or an inability to handle dissatisfied customers effectively.

How to Answer: Explain your strategy for identifying customer needs and recommending relevant products without being overly pushy.

Sample Answer: "I approach cross-selling by first understanding the customer's current financial situation and goals. I ask open-ended questions to uncover their needs and then suggest products that provide real value. For instance, if a customer mentions they're saving for a house, I might suggest a high-interest savings account or a mortgage consultation. My goal is to offer solutions that genuinely benefit the customer."

What to Look For: Look for candidates who focus on understanding customer needs and providing tailored recommendations. They should balance sales with customer service. Red flags include aggressive sales tactics or a lack of customer focus.

How to Answer: Describe your methods for staying informed about the bank's offerings, such as attending training sessions, reading internal communications, or using the products yourself.

Sample Answer: "I stay knowledgeable by regularly attending product training sessions and reading updates from our internal communications. I also take the time to explore and use the products myself to understand their features and benefits better. For example, I recently opened a new savings account offered by our bank to experience the process firsthand and better explain it to customers."

What to Look For: Candidates should demonstrate a proactive approach to learning about the bank's products. Look for specific methods they use to stay informed. Red flags include a lack of ongoing learning or unfamiliarity with key products.

How to Answer: Explain your approach to staying compliant with regulations, including following procedures, attending training, and staying updated on regulatory changes.

Sample Answer: "I ensure compliance by strictly following the bank's procedures and guidelines. I attend all mandatory training sessions and regularly review updates on regulatory changes. Additionally, I double-check transactions for compliance with relevant laws and report any suspicious activities promptly. For example, I always verify customer identification and document large transactions according to the AML guidelines."

What to Look For: Look for candidates who show a strong commitment to compliance and an understanding of regulatory requirements. Red flags include a casual attitude towards compliance or a lack of knowledge about key regulations.

Looking to ace your next job interview? We've got you covered! Download our free PDF with the top 50 interview questions to prepare comprehensively and confidently. These questions are curated by industry experts to give you the edge you need.

Don't miss out on this opportunity to boost your interview skills. Get your free copy now!

As a bank teller, you'll be expected to possess a solid understanding of financial concepts and banking technology to perform your duties effectively. Let's explore the key areas of technical knowledge that employers may assess during the interview process.

Financial literacy is fundamental for bank tellers, as they handle various transactions and inquiries related to customers' accounts. Here are some aspects of financial literacy that you may need to demonstrate:

In today's digital age, proficiency with banking software and technology is increasingly important for bank tellers. Here are some aspects of technology proficiency that you may be evaluated on:

In addition to these technical skills, employers may also assess your ability to adapt to new technologies and willingness to undergo training to stay updated on industry trends and advancements. Highlight any relevant experience with technology or software systems on your resume and be prepared to discuss how you can leverage technology to enhance the customer experience and streamline banking operations.

Beyond technical skills and qualifications, employers also look for candidates who align with the company culture and exhibit certain personal attributes that contribute to success in the role of a bank teller. Let's explore some of these essential qualities and how they factor into the interview process.

Employers want to know what drives you and how the bank teller role fits into your long-term career aspirations. Be prepared to articulate your motivations and career goals during the interview:

Working as a bank teller can be demanding, especially during peak hours or when handling complex transactions. Employers seek candidates who can remain calm, focused, and efficient under pressure:

Integrity is paramount in the banking industry, where trust and confidentiality are critical to maintaining customer relationships and safeguarding financial assets:

By showcasing these personal attributes and emphasizing your cultural fit with the organization, you can enhance your candidacy and demonstrate your readiness to excel as a bank teller. Prepare anecdotes and examples that illustrate these qualities and be ready to discuss how they align with the bank's values and expectations.

As an employer, conducting an effective bank teller interview is essential for identifying top talent and assessing candidates' suitability for the role. Let's explore some best practices for conducting a successful interview.

Creating a welcoming and comfortable environment sets the stage for a positive interview experience for both you and the candidate:

Active listening is a critical skill for interviewers, allowing you to gather valuable information and assess candidates' responses effectively:

Asking follow-up questions is an essential part of probing deeper into candidates' responses and gathering more detailed information:

By creating a comfortable environment, actively listening to candidates, and asking thoughtful follow-up questions, you can conduct a thorough and effective bank teller interview that helps you identify the best candidate for the role. Remember to treat candidates with respect and professionalism throughout the interview process, regardless of the outcome.

Assessing candidates effectively requires a comprehensive approach that considers various factors, including their skills, experiences, and fit with the organization.

By evaluating candidates holistically and considering a range of factors, you can make informed hiring decisions and select the best candidate to join your team as a bank teller. Remember to assess each candidate fairly and objectively, taking into account both their strengths and areas for growth.

Mastering bank teller interview questions is essential for both employers and candidates looking to navigate the hiring process successfully. For employers, effective interview questions provide valuable insights into candidates' skills, competencies, and cultural fit, enabling them to make informed hiring decisions and build high-performing teams. By asking targeted questions that assess specific job-related attributes, employers can identify candidates who possess the necessary qualifications and qualities to excel in the demanding role of a bank teller.

For candidates, preparing for bank teller interview questions is key to showcasing their strengths and suitability for the position. By understanding the role's responsibilities, skills, and industry-specific knowledge, candidates can anticipate interview questions and craft thoughtful responses that highlight their qualifications and experiences. Additionally, demonstrating professionalism, enthusiasm, and a genuine interest in serving customers can set candidates apart and leave a positive impression on interviewers. With thorough preparation and confidence in their abilities, candidates can approach bank teller interviews with poise and increase their chances of securing a rewarding career in the banking industry.