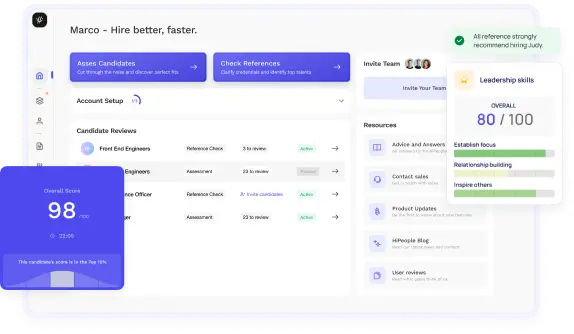

Streamline hiring with effortless screening tools

Optimise your hiring process with HiPeople's AI assessments and reference checks.

Are you curious about how overtime pay works and what it means for you? Overtime pay is a vital aspect of the workplace that affects both employees and employers. It ensures that those who work extra hours receive fair compensation for their time and effort, helping to maintain a balanced work-life dynamic. With the rise of remote work and varying job structures, understanding the ins and outs of overtime has never been more important.

Whether you're an employee striving to get paid what you deserve or an employer aiming to comply with labor laws while keeping your team happy, this guide breaks down everything you need to know. From the legal frameworks and calculations to common scenarios and best practices, we’re here to make overtime pay simple and straightforward, so you can navigate this crucial topic with confidence and clarity.

Overtime pay refers to the additional compensation that employees receive for working more than a designated number of hours in a workweek. Under the Fair Labor Standards Act (FLSA), the standard threshold for overtime eligibility is typically set at 40 hours per week. Employees who exceed this limit are entitled to earn at least 1.5 times their regular hourly rate for every hour worked beyond the 40-hour mark.

Overtime pay is designed to ensure that employees are fairly compensated for the extra time and effort they invest in their jobs, particularly when working long hours can lead to fatigue and decreased productivity. This additional pay serves not only as a financial incentive for employees to work overtime but also as recognition of the potential physical and mental strain associated with extended work hours.

Understanding the nuances of overtime pay is crucial for both employees and employers. This knowledge helps avoid confusion and ensures compliance with labor laws, ultimately fostering a fair and equitable workplace.

Understanding overtime pay is essential for maintaining a healthy work environment. Here are some key reasons why it matters for both employers and employees:

Understanding the legal framework surrounding overtime pay is crucial for both employees and employers. It not only defines who qualifies for overtime but also establishes the standards for calculating pay, ensuring that everyone is fairly compensated for their work.

The Fair Labor Standards Act (FLSA) is the cornerstone of federal legislation governing overtime pay in the United States. Enacted in 1938, the FLSA sets standards for minimum wage, overtime pay, recordkeeping, and youth employment. Under this law, employees who work over 40 hours in a workweek are entitled to receive overtime pay at a rate of at least 1.5 times their regular pay rate.

Certain categories of employees are covered under the FLSA, while others are exempt. The law requires employers to classify their employees correctly and ensure compliance with both wage and hour provisions. Violations of the FLSA can lead to hefty penalties, including back pay and fines.

It's important to note that the FLSA does not require employers to provide paid vacations, holidays, or sick leave, but if they do offer these benefits, they must comply with the same overtime laws.

While the FLSA sets a federal baseline for overtime regulations, many states have enacted their own laws that can offer more stringent protections for workers. For instance, some states require overtime pay for hours worked over eight in a single day, rather than the 40-hour weekly threshold mandated by federal law. This means that an employee who works a full 8-hour day, followed by an additional 2 hours, would qualify for overtime pay for those extra hours under state law, even if they haven’t exceeded the 40-hour workweek.

States such as California, Massachusetts, and New York have their own specific guidelines that can affect how overtime is calculated and when it applies. These regulations often include provisions for meal breaks, rest periods, and pay schedules, which can vary significantly from federal standards.

Employers must be vigilant in understanding and adhering to both federal and state laws. If state laws provide greater protections or benefits than federal law, employers are required to follow the stricter regulations.

A critical distinction in the realm of overtime pay is between exempt and non-exempt employees. Non-exempt employees are entitled to overtime pay under the FLSA, while exempt employees are not.

To determine whether an employee is exempt, employers typically consider the employee's job duties, salary level, and whether the position meets specific criteria outlined by the FLSA. Common exemptions include:

Understanding these classifications is essential, as misclassifying an employee as exempt when they should be non-exempt can lead to legal issues and financial repercussions for the employer. As an employee, knowing whether you are exempt or non-exempt helps you understand your rights and entitlements concerning overtime pay.

Calculating overtime pay accurately is essential for ensuring that employees are compensated fairly for their extra work hours. Understanding the intricacies of overtime calculation can help avoid costly mistakes and misunderstandings between employers and employees.

The standard workweek is typically defined as 40 hours in most sectors, although this can vary depending on state regulations and industry standards. According to the Fair Labor Standards Act (FLSA), any time worked beyond this threshold qualifies for overtime pay.

Employees must meet certain eligibility criteria to qualify for overtime pay. Non-exempt employees—those who are not excluded from the protections of the FLSA—are entitled to receive overtime pay. This classification typically includes hourly workers and some salaried employees, especially those engaged in manual labor or specific service roles.

It's crucial for both employees and employers to be aware of the specific thresholds that trigger overtime eligibility. For instance, certain jobs may have unique definitions of a standard workweek, particularly in fields like healthcare or emergency services where shift patterns differ significantly.

Calculating overtime pay can be straightforward, but it requires careful attention to detail. The most common method involves determining the employee's regular hourly wage and applying the overtime rate, which is usually 1.5 times this wage for hours worked beyond 40 in a week.

To calculate your overtime pay, follow this formula:

Overtime Pay = (Hourly Wage x 1.5) x Overtime Hours Worked

For example, if you earn $25 per hour and work 10 hours of overtime in a week, your calculation would look like this:

In some cases, employers may need to consider special circumstances that affect pay calculations, such as fluctuating workweeks or additional compensation (like bonuses) that could affect the regular rate of pay. It’s vital to ensure that all compensation is factored in correctly.

Even experienced employers can make mistakes in calculating overtime pay. Understanding these common pitfalls can help both parties avoid disputes and maintain compliance with labor laws.

One frequent mistake involves failing to account for all hours worked. Employees should ensure they log every hour, including time spent on breaks, training, or after-hours communications. If a worker checks emails from home after a long day, those hours may need to be considered when calculating total hours worked.

Another common error is not properly adjusting for changes in salary. For salaried employees, if their salary changes or they take unpaid leave, employers must recalculate the regular rate of pay before applying the overtime multiplier.

Additionally, some employers incorrectly classify employees as exempt or non-exempt, leading to potential violations of overtime laws. Misclassifying a non-exempt employee as exempt can result in serious consequences, including legal action and back pay owed.

Being aware of these issues and implementing accurate tracking systems, clear communication, and ongoing education about overtime regulations can help both employers and employees navigate the complexities of overtime pay more effectively.

Understanding how overtime pay is applied in different situations can clarify its practical implications for both employees and employers. Here are several scenarios that illustrate how overtime pay is calculated and the various factors that can influence it.

Imagine Sarah, an hourly employee who works as a customer service representative. Her regular hourly wage is $20, and she typically works a 40-hour week. This week, however, she worked 45 hours.

Calculation:

Sarah's total pay for the week would be calculated as follows:

John works as a nurse with a fluctuating schedule. He typically works 12-hour shifts. This week, he worked three shifts of 12 hours, totaling 36 hours. However, on his last shift, he worked an additional 4 hours.

In his state, nurses are entitled to overtime pay for any hours worked over 8 in a single day.

Calculation:

Assuming John's regular hourly rate is $25, the overtime pay would be calculated as follows:

John's total pay for the week would be:

Lisa is a project manager who earns an annual salary of $60,000. To find her hourly rate for calculating overtime, we first convert her salary into an hourly wage. Assuming she works a standard 40-hour workweek for 52 weeks:

Calculation:

This week, Lisa worked 50 hours, which means she worked 10 hours of overtime.

To calculate her overtime pay:

Her total pay for the week would be:

During the holiday season, a retail employee, Tom, usually works 35 hours a week. However, due to increased demand, he is required to work 50 hours one week.

Tom earns $15 per hour, and since he worked more than 40 hours, he qualifies for overtime pay.

Calculation:

Tom's total pay for the week would be:

Emma works in sales and has a base hourly wage of $18, but she also earns commission on her sales. This week, she worked 42 hours, and her commission for the week was $300.

Since she worked more than 40 hours, her overtime rate applies only to her base pay.

Calculation:

Emma's total pay for the week would be calculated as follows:

These examples demonstrate how various factors, such as hourly vs. salaried positions, shift work, and commission-based pay, can influence overtime calculations. Being aware of these scenarios can help both employees and employers better understand their rights and responsibilities regarding overtime pay.

Understanding overtime pay rates is crucial for both employees and employers to ensure fair compensation practices. The rules surrounding how overtime is calculated can vary significantly based on job roles and specific industry standards.

The standard overtime rate, mandated by the Fair Labor Standards Act (FLSA), is set at 1.5 times an employee’s regular hourly wage for all hours worked beyond 40 in a workweek. This means that if you typically earn $20 an hour, your overtime pay would be calculated as follows:

Overtime Rate = Regular Hourly Wage x 1.5

Overtime Rate = $20 x 1.5 = $30

This basic formula helps ensure that employees are compensated for the extra effort and time spent on the job, particularly when working long hours can impact their health and well-being. It serves not just as a financial incentive for extra work but also as a recognition of the additional stress and strain that extended hours can impose on employees.

While the standard rate applies broadly, certain industries may have specific rules that affect how overtime is calculated. For example, employees in the healthcare industry often work varying shifts and may qualify for overtime pay after working over eight hours in a single day rather than the traditional 40-hour workweek.

Similarly, jobs in sectors like construction or hospitality might have unique overtime rules due to the nature of the work. For instance, restaurant employees may find that overtime is calculated differently based on tip earnings and the complex interplay of hourly wages and tips received.

Industries such as transportation and emergency services may also have specific regulations governing overtime. Commercial drivers, for example, have their own sets of rules about maximum driving hours and when overtime applies. It’s important for both employers and employees to be well-versed in the specific overtime regulations that pertain to their industry to avoid misunderstandings and ensure compliance.

Certain situations call for exceptions to the standard overtime pay calculation. For example, double time is a common practice where employees receive twice their regular pay for working on holidays or during emergency situations. This practice serves as an incentive for employees to work during times when staffing is critical, such as during holidays or major events.

Holiday pay can also vary significantly depending on company policies and state laws. While federal law does not require employers to pay extra for holiday work, many companies offer enhanced rates as part of their benefits to attract and retain employees.

In addition, some states have laws that mandate specific pay rates for holidays. For example, an employer in New Jersey may be required to pay overtime for work performed on holidays, while another state might not have such a requirement.

Understanding these special cases can help both employees and employers navigate the complexities of overtime pay and ensure that fair practices are upheld in the workplace.

As an employer, understanding your responsibilities regarding overtime is essential for compliance with labor laws and for maintaining a positive workplace culture. Proper management of overtime can help avoid legal issues while ensuring that employees feel valued and fairly compensated.

Accurate record-keeping is a fundamental responsibility for employers when it comes to managing overtime pay. Under the FLSA, employers are required to keep detailed records of all hours worked by their employees. This includes not only the total hours worked each week but also any overtime hours, meal breaks, and time off.

Employers should maintain records that include:

Keeping meticulous records can help protect employers in the event of audits or disputes over overtime pay. It also serves as a useful reference for managing payroll and ensuring compliance with both federal and state regulations.

Transparent communication regarding overtime policies is critical for fostering trust and clarity in the workplace. Employers should clearly outline their policies regarding overtime pay, including eligibility, calculation methods, and any variations that apply based on role or industry.

Regular training sessions and accessible employee handbooks can be effective tools for ensuring that all employees understand the overtime policies in place. Open lines of communication allow employees to ask questions and seek clarification, reducing the likelihood of misunderstandings.

Employers should also inform employees about the process for requesting overtime, the expectations around advance notice, and any limitations that may apply. Ensuring that employees feel informed and supported contributes to a more engaged and satisfied workforce.

Setting realistic expectations regarding overtime is crucial for both employee satisfaction and operational efficiency. Employers should have discussions with their employees about potential overtime needs and the nature of their roles, especially in positions that often require additional hours.

By clearly communicating when overtime may be necessary, employers can help employees plan their schedules and commitments accordingly. Additionally, discussing the impact of overtime on work-life balance can foster a positive workplace culture and prevent burnout.

Employers should also ensure that employees understand the implications of working overtime, such as how it affects their workload and personal life. Offering flexibility, when possible, can help mitigate the stress associated with increased hours and contribute to a more positive work environment.

By actively managing expectations and maintaining open communication, employers can create a more harmonious workplace where employees feel valued and understood.

Understanding your rights regarding overtime pay is essential for ensuring fair treatment in the workplace. Employees have several protections under the law that help safeguard their rights to proper compensation for overtime work.

Every non-exempt employee has the legal right to receive fair compensation for overtime hours worked, which is typically calculated at a rate of 1.5 times their regular hourly wage. This right is protected by the Fair Labor Standards Act (FLSA), which mandates that employers adhere to these overtime pay requirements.

Employees should be vigilant in understanding their classification as exempt or non-exempt, as this determines their eligibility for overtime pay. If you believe you are entitled to overtime pay, it's essential to keep accurate records of your hours worked, including regular and overtime hours.

Additionally, if your employer fails to pay you the correct amount for overtime, you have the right to seek resolution. This could involve addressing the issue directly with your supervisor or human resources department or escalating the matter to a legal professional if necessary.

Knowing your rights empowers you to advocate for fair compensation and ensures that you are treated equitably in your workplace.

If you believe your rights to overtime compensation have been violated, there are steps you can take to report these violations. Initially, it's advisable to bring the matter to your employer's attention. This can often resolve the issue directly without the need for further action.

If your concerns are not addressed, or if you experience retaliation for raising the issue, you can file a complaint with the U.S. Department of Labor’s Wage and Hour Division. They can investigate the complaint and take appropriate action to enforce the law.

It's important to document your hours worked, any communications with your employer regarding pay issues, and any relevant policies that may support your claim. This documentation can be critical in substantiating your case if it escalates to legal action.

Employees who report violations of overtime pay laws are protected under whistleblower protections. This means that if you report your employer for not complying with overtime regulations, you cannot be legally retaliated against, fired, or discriminated against for speaking up.

These protections encourage employees to report violations without fear of losing their jobs or facing other negative consequences. If you experience any form of retaliation after reporting a pay issue, it is essential to document the incident and seek legal advice immediately. Understanding your rights and the protections available can help you feel secure in advocating for fair treatment.

Various work situations can affect how overtime is managed and compensated. Familiarizing yourself with these common scenarios can help you navigate the complexities of overtime pay.

In industries where employees work in shifts, such as healthcare, manufacturing, or hospitality, overtime calculations can become complicated. Employees may have varying schedules, and the nature of shift work often leads to irregular hours.

For example, a nurse working a 12-hour shift may find themselves working overtime if their shift extends beyond the standard hours due to emergencies or staffing shortages. Understanding how overtime is calculated in such scenarios is crucial. In many states, employees are entitled to overtime pay if they work more than a specific number of hours in a single day, even if they haven’t reached the 40-hour threshold for the week.

Clear communication between employers and employees about scheduling expectations and overtime pay can help alleviate confusion and ensure fair compensation.

As remote work becomes increasingly common, it brings new challenges regarding overtime management. Employers must adapt their policies to ensure they accurately track hours worked by remote employees.

Employees should maintain clear records of their work hours, including when they start and finish each day, along with any breaks taken. This can help ensure that they receive fair compensation for any overtime worked.

Employers should also establish clear guidelines regarding when overtime may be necessary and how it should be documented. Providing remote workers with tools to easily track their hours can help prevent disputes and ensure compliance with overtime regulations.

Many industries experience seasonal fluctuations in workload, leading to variations in hours worked by employees. For example, retail businesses may require employees to work overtime during busy holiday seasons, while agricultural workers might see extended hours during harvest times.

Understanding how these fluctuations affect overtime pay is essential. Employers should proactively communicate with employees about potential overtime needs during peak times and provide guidance on how overtime will be compensated.

Employees should also keep an eye on their hours during these busy periods to ensure they are correctly compensated for any overtime worked. Establishing clear expectations and processes for managing seasonal work can help prevent misunderstandings and maintain a positive work environment.

By being aware of these common overtime scenarios, both employees and employers can work together to navigate the complexities of overtime pay, ensuring fair treatment and compliance with labor laws.

Employers play a crucial role in ensuring fair overtime practices and compliance with labor laws. Adopting best practices can help create a transparent and supportive work environment while minimizing the risk of legal issues.

As an employee, knowing how to navigate overtime policies can empower you to advocate for your rights and ensure fair compensation. Here are some helpful tips to keep in mind:

Understanding overtime pay is essential for both employees and employers to create a fair and productive workplace. With clear regulations in place, employees can ensure they receive the compensation they deserve for their hard work and extra hours. Employers benefit from being informed about overtime policies, allowing them to manage their workforce effectively while maintaining compliance with labor laws. By fostering open communication about expectations and providing transparency around pay structures, businesses can build trust and satisfaction within their teams.

As you navigate the world of overtime pay, remember that knowledge is your best ally. Whether you’re tracking your hours as an employee or managing payroll as an employer, staying informed about your rights and responsibilities can help prevent misunderstandings and disputes. The landscape of work is continually evolving, and being proactive about overtime issues can lead to a healthier work environment for everyone involved. By prioritizing fair compensation and mutual understanding, both employees and employers can thrive together, ensuring a harmonious and motivated workplace.