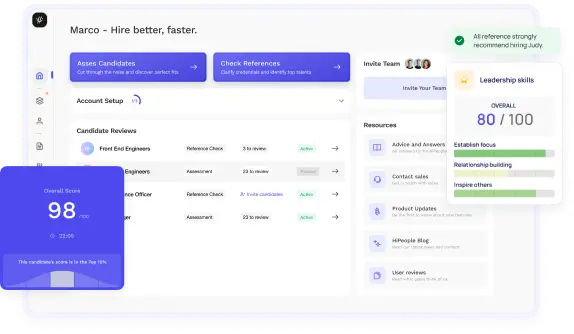

Streamline hiring with effortless screening tools

Optimise your hiring process with HiPeople's AI assessments and reference checks.

Have you ever wondered how supplemental pay can boost your earnings and enhance your job satisfaction? Supplemental pay refers to any additional compensation you receive beyond your regular salary or hourly wage, and it can take many forms, including bonuses, overtime pay, and commissions. Understanding the ins and outs of supplemental pay is essential for both employees and employers. For employees, knowing how to navigate and negotiate these additional pay structures can lead to increased earnings and a greater sense of value at work. For employers, implementing effective supplemental pay strategies can motivate teams, improve performance, and foster a positive workplace culture.

This guide will break down everything you need to know about supplemental pay, from its different types and legal considerations to best practices for negotiation and evaluation. Whether you're looking to maximize your compensation or create a rewarding pay structure for your team, this guide is here to help you make sense of it all in a friendly and approachable way!

Supplemental pay refers to any additional compensation provided to employees beyond their regular wages or salary. This can include a wide range of financial incentives such as bonuses, overtime pay, commissions, hazard pay, and shift differentials. Supplemental pay is designed to reward employees for their contributions, motivate performance, and address specific job-related challenges.

Understanding supplemental pay is crucial as it forms a significant part of total compensation. For many employees, it can enhance their overall earnings and play a pivotal role in job satisfaction. Employers, on the other hand, can use supplemental pay strategically to boost employee engagement and retention.

Having a clear understanding of supplemental pay is essential for both employees and employers. Recognizing its significance can lead to better financial decisions, enhanced job satisfaction, and improved workplace dynamics. Here are key reasons why understanding supplemental pay matters:

By grasping the definition and significance of supplemental pay, both employees and employers can navigate the complexities of compensation more effectively. This understanding lays the groundwork for a more motivated, engaged, and satisfied workforce, ultimately contributing to the overall success of the organization.

Supplemental pay encompasses various forms of additional compensation that can significantly enhance an employee’s overall earnings. Understanding these types is essential for both employers designing compensation packages and employees navigating their pay structures. Each type serves a unique purpose and can impact job satisfaction, performance, and retention.

Overtime pay is designed to compensate employees for the extra hours they work beyond the standard full-time schedule, typically defined as 40 hours per week in the U.S. According to the Fair Labor Standards Act (FLSA), eligible employees must receive at least one and a half times their regular pay rate for each hour worked over 40 in a workweek. This regulation exists to ensure that employees are fairly compensated for the additional time and effort they dedicate to their jobs.

Employers need to track hours worked accurately to comply with overtime regulations. Failure to do so can result in legal penalties and dissatisfaction among employees. It's also important to communicate overtime policies clearly, so employees know when they are eligible for overtime pay and how it will be calculated.

Bonuses and incentives are powerful tools that employers can use to motivate employees and recognize exceptional performance. These payments can take many forms, including performance bonuses, holiday bonuses, and referral bonuses.

Performance bonuses are typically awarded based on individual or team achievements, encouraging employees to exceed their targets. For example, a sales team might receive bonuses based on hitting quarterly sales goals, while project teams may earn bonuses for completing projects ahead of schedule.

Holiday bonuses, often provided during festive seasons, can enhance employee morale and foster a sense of appreciation. Employers might choose to give a flat bonus amount or calculate it as a percentage of the employee's annual salary, showing employees that their hard work throughout the year is valued.

Referral bonuses reward employees for bringing in new talent. When an existing employee refers a candidate who is successfully hired and remains with the company for a specified period, the referring employee receives a bonus. This practice not only encourages employees to help build their teams but also enhances employee engagement and loyalty.

Commission structures are particularly common in sales roles, where compensation is tied directly to the sales an employee generates. This performance-based pay structure motivates employees to maximize their efforts, driving sales and revenue for the company.

Commissions can be structured in several ways, including flat-rate commissions, tiered commissions, and residual commissions. A flat-rate commission pays a fixed percentage for each sale made. For example, if you sell a product for $200 with a 10% commission rate, you would earn $20 for that sale.

Tiered commissions reward employees for reaching specific sales thresholds. For instance, you might earn a 5% commission on sales up to $10,000, then 7% on sales between $10,001 and $20,000, and 10% on sales exceeding $20,000. This structure encourages employees to strive for higher sales and rewards them for achieving more.

Residual commissions are common in industries like insurance and subscription services, where employees earn ongoing commissions for sales that provide recurring revenue. For example, if you sell an insurance policy, you might continue to earn a commission on the policy's renewal each year.

Hazard pay is an essential form of supplemental compensation that reflects the increased risk associated with specific jobs. Employees in hazardous work environments, such as construction, emergency response, and healthcare during crises, often receive hazard pay as an incentive for taking on additional risks.

This type of pay is particularly important in industries where employees face physical dangers or health risks. For instance, during the COVID-19 pandemic, healthcare workers frequently received hazard pay for their critical roles and the risks involved in providing care to infected patients. Employers may set hazard pay rates based on the nature of the job and the level of risk involved, ensuring that employees are compensated fairly for their willingness to work under challenging conditions.

Shift differentials are additional compensation provided to employees who work less desirable hours, such as night shifts, weekends, or holidays. These payments help encourage employees to take on shifts that might be difficult to staff and acknowledge the inconvenience of working outside traditional hours.

For example, if a company typically pays $15 per hour for day shifts, it might offer $17 per hour for night shifts. This structure not only attracts employees to work during these times but also helps maintain adequate staffing levels, ensuring that operations run smoothly.

Employers should clearly communicate shift differential policies to employees, including when these rates apply and how they are calculated. This transparency fosters trust and helps employees understand their compensation better.

Severance pay is compensation offered to employees upon termination, often as part of a layoff or workforce reduction. This payment provides financial support during a challenging transition period, helping employees cover their expenses while they search for new job opportunities.

The amount of severance pay can vary significantly based on company policies, employee tenure, and individual contracts. Some organizations provide a standard formula, such as one week’s pay for every year of service. Others may offer a lump sum or continue health benefits for a specified period.

Providing severance pay not only reflects an employer's commitment to supporting their employees during difficult times but also enhances the company’s reputation and can mitigate potential legal issues related to terminations. It shows that the employer values the contributions of their employees and wants to help them succeed even after their employment ends.

Understanding the various types of supplemental pay is crucial for both employers and employees. By recognizing these forms of compensation, you can better navigate your workplace's financial landscape and make informed decisions about your career and compensation strategies.

As an employee, having a solid understanding of supplemental pay is essential for maximizing your earnings and ensuring you are fairly compensated for your contributions. Supplemental pay not only affects your overall financial situation but also plays a crucial role in job satisfaction and long-term career planning. Here are key considerations to help you navigate supplemental pay effectively.

Negotiating supplemental pay can feel daunting, but it’s a vital skill that can lead to better financial outcomes and job satisfaction. To effectively negotiate supplemental pay, consider the following strategies:

When assessing your job offer or current position, it’s important to evaluate the total compensation package, not just the base salary. Supplemental pay can significantly impact your overall earnings and job satisfaction. Here’s how to effectively evaluate your total compensation:

Understanding your rights and responsibilities concerning supplemental pay is essential for ensuring fair treatment in the workplace. Here’s what you need to know:

By understanding supplemental pay from your perspective as an employee, you can navigate your compensation strategy more effectively. Whether you’re negotiating your pay, evaluating your overall compensation package, or ensuring your rights are upheld, being informed empowers you to make decisions that align with your career goals.

The structure of supplemental pay is crucial for both employers looking to attract and retain talent and employees aiming to maximize their compensation. Various approaches can be taken when designing supplemental pay systems, and understanding the distinctions between these structures can help you make informed decisions regarding your financial well-being.

Fixed compensation refers to a guaranteed amount of pay that an employee receives regularly, regardless of performance or company performance. This type of pay typically includes salaries and hourly wages. Fixed compensation provides employees with a stable income and is often used to establish a base level of financial security.

On the other hand, variable compensation is contingent upon performance or specific outcomes. This includes bonuses, commissions, and profit-sharing arrangements that fluctuate based on individual, team, or company performance. Variable compensation can be a powerful motivator, encouraging employees to achieve their goals and contribute to the organization’s success.

The choice between fixed and variable compensation often depends on the nature of the job, the company culture, and the desired outcomes. For example, sales positions may rely heavily on variable compensation to drive performance, while roles requiring consistent, steady work may focus more on fixed compensation.

Employers should carefully consider the balance between fixed and variable pay to create a compensation strategy that aligns with organizational goals and motivates employees. Employees, in turn, should understand how their compensation structure impacts their earnings and job satisfaction.

Determining eligibility for supplemental pay is an essential aspect of compensation structures. Employers need to establish clear criteria to ensure fairness and transparency in how supplemental pay is distributed.

Eligibility for supplemental pay often depends on various factors, including:

By clearly defining eligibility criteria, employers can ensure a fair and consistent approach to supplemental pay, fostering trust and satisfaction among employees.

Establishing performance metrics is crucial for determining the effectiveness of supplemental pay, particularly for bonuses and incentives. These metrics help employers measure individual and team contributions to organizational goals, guiding compensation decisions. Here are some of the top performance metrics used to assess eligibility for bonuses and incentives, along with their calculations:

By establishing clear performance metrics, employers can create an effective incentive structure that aligns with organizational objectives while motivating employees to perform at their best. Employees should be aware of these metrics and how they influence their supplemental pay, allowing them to focus their efforts on achieving these goals. Understanding these structures can help you navigate your compensation effectively, whether you are an employer or an employee.

Understanding how supplemental pay works is often best illustrated through real-world examples. Here are several common types of supplemental pay, along with specific scenarios that demonstrate their application in various workplaces.

Overtime pay is a straightforward and widely recognized form of supplemental pay. For example, consider an employee named Jane who works as a customer service representative. Jane’s standard workweek consists of 40 hours, with an hourly rate of $20. One week, due to a surge in customer inquiries, Jane works 48 hours. According to the Fair Labor Standards Act (FLSA), she is entitled to overtime pay for the extra 8 hours.

Calculation:

In this scenario, Jane’s supplemental pay through overtime significantly increases her earnings for that week, rewarding her for her extra effort.

Performance bonuses are often used to reward employees for achieving specific goals. For instance, a sales team at a tech company has a target to reach $1 million in sales for the quarter. The management decides to offer a performance bonus of $5,000 to each team member if the target is met. The team works diligently, and by the end of the quarter, they surpass their goal, achieving $1.2 million in sales.

Each sales representative, including Mike, receives the $5,000 bonus in addition to their regular salary. This performance bonus not only incentivizes Mike to perform well but also fosters teamwork among his colleagues as they all work toward a common objective.

Commission pay is prevalent in sales roles, where earnings are directly tied to performance. Take Sarah, a real estate agent, who earns a base salary of $30,000 per year but also receives a 3% commission on each property she sells. If Sarah sells a property worth $500,000, her commission from that sale would be:

Calculation:

Commission from sale: $500,000 × 0.03 = $15,000

In a good year, if Sarah sells multiple properties, her total earnings can significantly exceed her base salary, providing a strong incentive for her to close more deals.

Hazard pay is compensation for employees who work in dangerous or risky environments. For example, consider a firefighter named David who is deployed to respond to a major wildfire. Due to the high-risk nature of his job, the fire department offers an additional $200 per day as hazard pay while he is on duty in the field.

If David works a 10-day assignment during the wildfire, his hazard pay would amount to:

Calculation:

Total hazard pay: $200 × 10 = $2,000

This supplemental pay acknowledges the dangers David faces while performing his duties and provides him with extra financial support during this challenging period.

Shift differentials are used to incentivize employees who work less desirable hours. For instance, a hospital might offer a shift differential of $5 per hour for nurses who work the night shift. Emily, a registered nurse, typically earns $25 per hour during the day. However, when she works the night shift, her pay increases to:

Calculation:

Night shift pay: $25 + $5 = $30 per hour

If Emily works a 12-hour night shift, her earnings for that shift would be:

Total pay for the shift: $30 × 12 = $360

This differential encourages nurses to fill night shifts, ensuring that the hospital maintains adequate staffing levels around the clock.

Severance pay is often provided to employees who are laid off or terminated. For instance, a company may offer its employees one week of pay for every year of service upon termination. If John has worked at the company for 8 years and his weekly salary is $1,000, his severance pay would be calculated as follows:

Calculation:

Severance pay: $1,000 × 8 = $8,000

This severance package helps support John as he transitions to new employment, demonstrating the company’s commitment to its employees even during challenging times.

These examples illustrate the various forms of supplemental pay and how they function in real-world scenarios. By understanding these concepts, both employees and employers can make informed decisions regarding compensation strategies that enhance motivation, job satisfaction, and overall workplace effectiveness.

Supplemental pay plays a vital role in shaping employee motivation and retention within an organization. When structured effectively, it can lead to numerous positive outcomes for both employees and employers. Understanding these impacts can help you as an employer create a more engaging work environment or enable you as an employee to leverage your compensation for better career satisfaction.

Employers looking to implement or enhance supplemental pay structures should follow best practices to ensure fairness, transparency, and effectiveness. By adopting these practices, you can create a more engaged workforce and promote a positive workplace culture.

By adopting these best practices, employers can effectively implement supplemental pay structures that motivate employees, enhance retention, and foster a positive workplace environment. Understanding the nuances of supplemental pay allows for a more strategic approach to compensation, benefiting both employers and employees alike.

Understanding the legal landscape surrounding supplemental pay is essential for both employers and employees. Various laws and regulations govern how supplemental pay is structured, calculated, and distributed. Knowing these legal considerations can help ensure compliance and promote fair practices in the workplace.

The Fair Labor Standards Act (FLSA) is a federal law that sets the groundwork for minimum wage, overtime pay, and child labor standards in the United States. It is crucial for employers and employees to understand how the FLSA affects supplemental pay, particularly regarding overtime compensation.

Under the FLSA, non-exempt employees are entitled to receive overtime pay for hours worked over 40 in a workweek at a rate of at least one and a half times their regular pay. This law protects workers from exploitation by ensuring they are fairly compensated for their time and efforts.

Employers must carefully classify employees as either exempt or non-exempt based on their job duties and salary levels. Exempt employees, such as certain executive, administrative, or professional workers, are not entitled to overtime pay, while non-exempt employees must receive it. Misclassifying employees can lead to legal repercussions, including back pay and penalties.

The FLSA also mandates that employers maintain accurate records of hours worked and wages paid. This record-keeping is vital for both compliance and transparency, as it allows employees to verify their compensation and ensure they are receiving what they are owed.

In addition to federal laws, various states have their own regulations regarding supplemental pay that can differ significantly from the FLSA. Many states have established minimum wage laws that exceed the federal standard, and some mandate additional overtime pay provisions.

For example, some states require employers to pay overtime for hours worked over eight in a single day, rather than just over 40 in a week. Additionally, state laws might stipulate specific requirements for paid sick leave, family leave, and holiday pay, which can further affect supplemental pay structures.

Employers must be diligent in understanding and adhering to state-specific regulations to ensure compliance. This may involve consulting legal experts or human resources professionals who are well-versed in local labor laws.

Supplemental pay can have various tax implications for employees that are essential to understand. Generally, supplemental pay is subject to federal income tax, Social Security tax, and Medicare tax, just like regular wages. However, there may be differences in how these payments are taxed compared to regular income.

For instance, bonuses are often taxed at a flat rate for federal income tax purposes. The IRS allows employers to withhold a specific percentage for bonuses (currently 22%) instead of the employee's normal withholding rate. This can lead to employees receiving a larger portion of their bonus in take-home pay upfront, but it might result in a tax liability when they file their annual returns, especially if they end up in a higher tax bracket.

Employees should also consider the impact of supplemental pay on their overall tax situation, including deductions and credits that might be affected by fluctuations in their annual income. It can be beneficial for employees to consult with tax professionals to understand how supplemental payments influence their taxes.

Employers have a responsibility to comply with various legal requirements regarding supplemental pay. This includes understanding the FLSA and state-specific regulations, accurately classifying employees, and maintaining proper records.

Employers must ensure they are providing the appropriate supplemental pay, such as overtime, bonuses, or commissions, based on established criteria and legal standards. This involves creating clear policies and procedures for determining eligibility for supplemental pay and communicating these policies effectively to all employees.

In addition to compliance with wage and hour laws, employers must also consider the implications of the Equal Pay Act, which prohibits wage discrimination based on gender. Employers should regularly review their pay practices to ensure they are equitable and fair, as discrepancies can lead to legal challenges and damage employee morale.

Regular training for HR personnel and management on legal obligations and best practices is vital for fostering a culture of compliance within the organization. By proactively addressing legal considerations and maintaining transparency in pay practices, employers can mitigate risks and create a positive workplace environment.

Navigating the legal aspects of supplemental pay can be complex, but understanding these considerations is crucial for fostering fair compensation practices. Whether you're an employer aiming for compliance or an employee seeking clarity about your rights, being informed about the legal framework surrounding supplemental pay is essential.

Understanding supplemental pay is essential for anyone involved in the workforce, whether you're an employee aiming to maximize your earnings or an employer looking to build a motivated team. By grasping the different types of supplemental pay available, such as bonuses, overtime, and commissions, you can make informed decisions that impact your financial well-being. Remember, it’s not just about the base salary; supplemental pay can significantly enhance your overall compensation package. This knowledge allows you to negotiate effectively, ensuring you are compensated fairly for your contributions and achievements.

For employers, recognizing the importance of supplemental pay is a key strategy for attracting and retaining talent. A well-structured supplemental pay system can motivate employees to perform at their best and align their goals with the organization’s success. By implementing transparent policies and regularly reviewing compensation practices, you can foster a positive workplace culture where employees feel valued and engaged. Ultimately, understanding and leveraging supplemental pay not only benefits individual employees but also enhances the overall health and productivity of the organization. With this guide, you now have the tools and insights to navigate the world of supplemental pay confidently and effectively.